Tokenisation

Securely reference your customer’s payment data.

Use tokenisation to replace the individual card payment details of your customer with a non-identifiable series of numbers and letters, i.e. “tokens”. Substituting sensitive data with random irreversible tokens lets you safely reference your customers’ payment cards without having to store their data. There is no limit to the number of tokens you can assign.

Benefits of tokenisation:

- Reduce PCI DSS compliance by limiting the amount of sensitive data that needs protection

- Store card payment details to provide one-click payments for repeat customers

- Secure your payment processing with tokens that expire when the substituted cards expire

Enable tokenisation for a new or existing customer when they make a payment to the emerchantpay payment gateway. Their payment details are saved in a secure token vault and substituted with an irreversible token that is returned as part of the transaction response. In future transactions, reference the token rather than the sensitive card data to reduce your security exposure. Tokenising a card payment allows a returning customer to select the previously used card and enter in only the CVC/CVV code to confirm the payment.

Tokenise payments made with these transaction types:

- Account Verification

- Authorize

- Authorize3D

- Fashioncheque

- Intersolve

- InitRecurringSale

- InitRecurringSale3D

- Payout

- Sale

- Sale3D

Tokenisation is available for server-to-server and Web Payment Form (WPF) integrations. Continue reading for more information on how to tokenise your customers’ payment data for each integration.

Tokenisation on the emerchantpay Web Payment Form (WPF)

The emerchantpay Web Payment Form (WPF) provides tokenisation of card payment details that your customer can use in future payments. Because the tokenised data, the token, and the option to use tokenisation are provided as part of a hosted payment page , you do not need to save the token on your servers.

Prerequisites

To proceed with this solution, you must have an emerchantpay merchant account. Apply for a merchant account by filling out and submitting this contact form.

You will be assigned an emerchantpay Account Manager, who will provide you with credentials and assist you with any of emerchantpay’s payment solutions.- Verify that WPF tokenisation is enabled for your account:

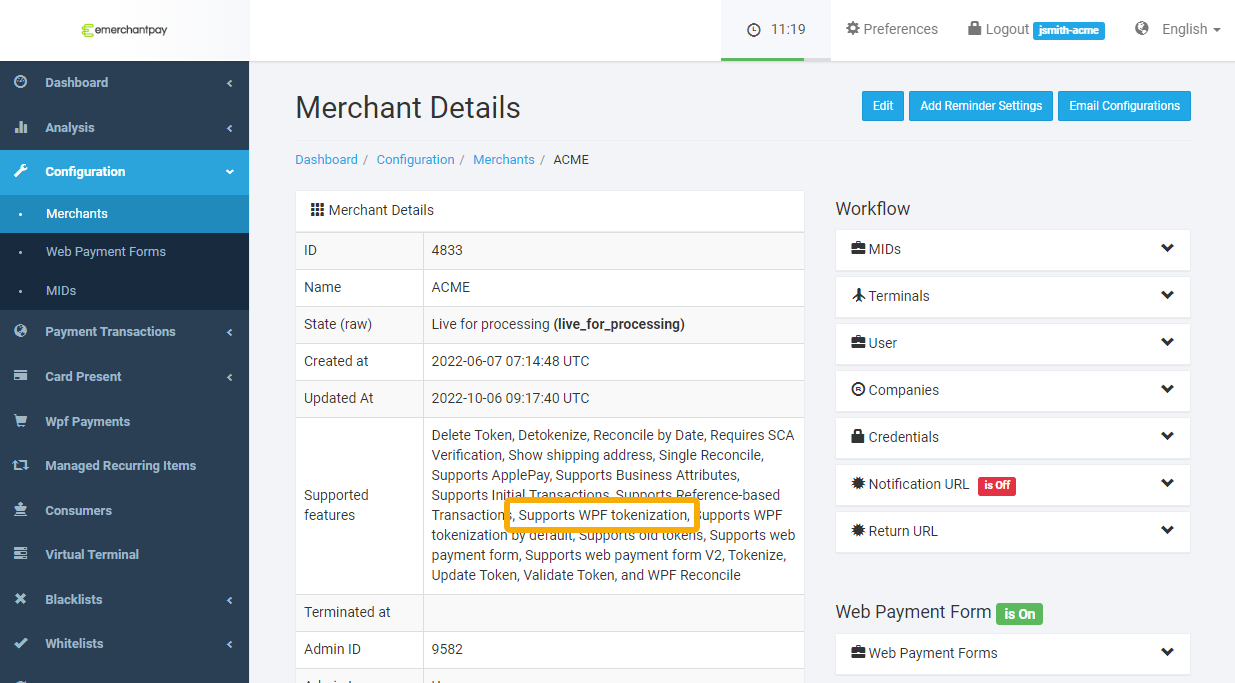

- Log in to your Genesis Merchant Console

- In the Configuration > Merchants menu, select your account

- in the Supported features row, locate the Supports WPF tokenization entry:

If the Supports WPF tokenization or other features related to tokenisation are missing, contact emerchantpay support. - A database or storage system is recommended to associate and reference your customers in subsequent transactions

Enable tokenisation of customer card payment details entered in the WPF

To allow your customer to tokenise their card payment details, pass the remember_card parameter with the WPF Create method.

remember_card parameter passed with the initial Create method request:

<?xml version=”1.0″ encoding=”UTF-8″?>

<wpf_payment>

<transaction_id>119643250547501c79d8295</transaction_id>

<usage>40208 concert tickets</usage>

<description>You are about to buy 3 tickets.</description>

<notification_url>https://www.example.com/notification</notification_url>

<return_success_url>http://www.example.com/success</return_success_url>

<return_failure_url>http://www.example.com/failure</return_failure_url>

<return_cancel_url>http://www.example.com/cancel.html</return_cancel_url>

<return_pending_url>http://www.example.com/payment-pending.html</return_pending_url>

<amount>100</amount>

<currency>USD</currency>

<customer_email>jsmith@example.com</customer_email>

<customer_phone>+001234567890</customer_phone>

<remember_card>true</remember_card>

<lifetime>60</lifetime>

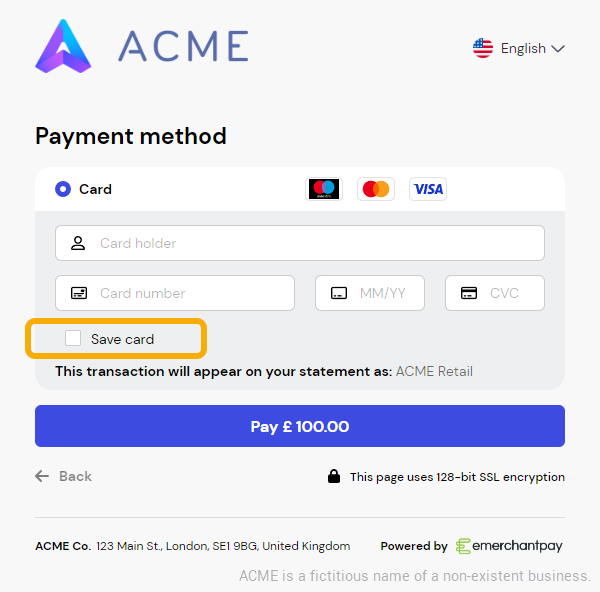

Even with the remember_card parameter, your customer must select Save card to tokenise their payment details. Sensitive payment data will not be stored if your customer does not select Save card, but they will still be associated with a consumer ID.

consumer_id in subsequent transactions.

After the transaction is processed (see Payment flow for the complete transaction flow), the WPF Notification returns a consumer_id that this email address is associated with.

consumer_id in a notification from the emerchantpay gateway:

signature=c5219b3d385e74496b2b48a5497b347e102849f10eacd25b062f823b

&payment_transaction_transaction_type=sale3d

&payment_transaction_terminal_token=e9fd7a957845450fb7ab9dccb498b6e1f6e1e3aa

&payment_transaction_unique_id=bad08183a9ec545daf0f24c48361aa10

&payment_transaction_amount=500

&wpf_transaction_id=mtid201104081447161135536962

&wpf_status=approved

&wpf_unique_id=26aa150ee68b1b2d6758a0e6c44fce4c

&consumer_id=123456

&payment_transaction_token=ee946db8-d7db-4bb7-b608-b65b153e127d

¬ification_type=wpf

&eci=05

&payment_transaction_avs_response_code=5I

&payment_transaction_avs_response_text=Response+provided+by+issuer+processor%3B+Address+information+not+verified

&payment_transaction_cvv_result_code=M

&authorization_code=005645

&retrieval_reference_number=016813015184

&scheme_response_code=00

&scheme_transaction_identifier=MCS267BG0

&scheme_settlement_date=1103

&threeds_authentication_flow=payer_authentication

&threeds_target_protocol_version=1

&threeds_concrete_protocol_version=1emerchantpay recommends that you use a database or storage system to store and associate the consumer_id that is returned with each email address.

customer_email with a returned consumer_id:

| Name | customer_email | consumer_id |

|---|---|---|

| John Smith | jsmith@example.com | 123456 |

| Jennifer J. Morrison | jenniferm@example.com | 987654 |

| Narayan Singh | nsingh@example.com | 456123 |

If your customer has selected Save card they will see their stored cards when you pass their associated parameters in subsequent transactions.

Example of creating a subsequent customer transaction with theirconsumer_id and associated customer_email alongside the remember_card parameter:

<?xml version=”1.0″ encoding=”UTF-8″?>

<wpf_payment>

<transaction_id>119643250547501c79d8295</transaction_id>

<usage>40208 concert tickets</usage>

<description>You are about to buy 3 tickets.</description>

<notification_url>https://www.example.com/notification</notification_url>

<return_success_url>http://www.example.com/success</return_success_url>

<return_failure_url>http://www.example.com/failure</return_failure_url>

<return_cancel_url>http://www.example.com/cancel.html</return_cancel_url>

<return_pending_url>http://www.example.com/payment-pending.html</return_pending_url>

<amount>100</amount>

<currency>USD</currency>

<consumer_id>123456</consumer_id>

<customer_email>jsmith@example.com</customer_email>

<customer_phone>+001234567890</customer_phone>

<remember_card>true</remember_card>

<lifetime>60</lifetime>consumer_id that is associated with the customer_email for each subsequent Create method request.

If your customer has previously saved their card, their card details will be prefilled and they must enter in only the CVC/CVV code to confirm the payment.

Tokenisation in a server-to-server integration

In a server-to-server integration, tokenise your customers’ payment details to minimise your security exposure when you send a payment from your server to the emerchantpay payment gateway.

Prerequisites

To proceed with this solution, you must have an emerchantpay merchant account. Apply for a merchant account by filling out and submitting this contact form.

You will be assigned an emerchantpay Account Manager, who will provide you with credentials and assist you with any of emerchantpay’s payment solutions.- Your server must be

PCI DSS

certified server to:

Gather raw customer payment data, such as on a form you host on your site

If you have enabled Client-side Encryption for your server, you can gather customer data without being PCI DSS certified.See Use the CSE library in your payment form for more information.Detokenise a token to reveal the substituted cardholder data

- A database or storage system is recommended to associate and reference your customers’ tokens

Tokenise customer card payment details in a server-to-server integration

To tokenise a customer’s card details, pass the remember_card parameter with the transaction request to enable tokenisation of the passed card payment details.

remember_card parameter passed with the initial transaction request:

<?xml version=”1.0″ encoding=”UTF-8″?>

<payment_transaction>

<transaction_type>sale</transaction_type>

<transaction_id>119643250547501c79d8295</transaction_id>

<usage>40208 concert tickets</usage>

<remote_ip>245.253.2.12</remote_ip>

<amount>100</amount>

<currency>USD</currency>

<card_holder>John Smith</card_holder>

<card_number>4200000000000000</card_number>

<expiration_month>12</expiration_month>

<expiration_year>2023</expiration_year>

<cvv>123</cvv>

<customer_email>jsmith@example.com</customer_email>

<customer_phone>+1987987987987</customer_phone>

<remember_card>true</remember_card>

</payment_transaction>After the transaction is processed (see server-to-server for the complete transaction flow), the transaction response provides a consumer_id and token that the provided customer_email is associated with.

consumer_id and token in a transaction response from the emerchantpay gateway:

<?xml version=”1.0″ encoding=”UTF-8″?>

<payment_response>

<transaction_type>authorize</transaction_type>

<status>approved</status>

<mode>live</mode>

<transaction_id>119643250547501c79d8295</transaction_id>

<unique_id>44177a21403427eb96664a6d7e5d5d48</unique_id>

<consumer_id>123456</consumer_id>

<token>ee946db8-d7db-4bb7-b608-b65b153e127d</token>

<avs_response_code>5I</avs_response_code>

<avs_response_text>Response provided by issuer processor; Address information not verified</avs_response_text>

<cvv_result_code>M</cvv_result_code>

<authorization_code>345678</authorization_code>

<retrieval_reference_number>016813015184</retrieval_reference_number>

<response_code>00</response_code>

<timestamp>2022-07-11T14:12:42Z</timestamp>

<descriptor>Descriptor one</descriptor>

<amount>100</amount>

<currency>USD</currency>

<sent_to_acquirer>true</sent_to_acquirer>

<scheme_transaction_identifier>019091214161031</scheme_transaction_identifier>

<scheme_settlement_date>0712</scheme_settlement_date>

<scheme_response_code>00</scheme_response_code>

</payment_response>Be sure to store all tokens returned for a customer_id and customer_email combination. To determine which saved card (token) to use for a returning customer, use the Get card method or reconcile the payment to get the

masked cardholder PAN.

card_number parameter of a response to a get_card_request:

<?xml version=”1.0″ encoding=”UTF-8″?>

<get_card_response>

<status>active</status>

<token_id>98765</token_id>

<token_type>uuid</token_type>

<card_data>

<card_number>420000…0000</card_number>

<card_holder>John Smith</card_holder>

<expiration_month>12</expiration_month>

<expiration_year>2023</expiration_year>

<card_brand>visa</card_brand>

</card_data>

</get_card_response>To reference returning customers, store the email alongside the consumer_id that is returned with the payment result:

- With the initial transaction request, store the passed

customer_emailalongside any optional identifier such as the customer name. - From the payment response, store the returned

consumer_idandtokenalongside the customer email. - Use the Get card method or perform a reconcile to get the masked cardholder PAN. Store the masked PAN alongside the other customer information.

customer_email with returned consumer_id and token(s) and masked PAN:

| Name | customer_email | consumer_id | token | masked Pan |

|---|---|---|---|---|

| John Smith | jsmith@example.com | 123456 | ee946db8-d7db-4bb7-b608-b65b153e127d | 420000…0000 |

| John Smith | jsmith@example.com | 123456 | jk976jt1-d2db-1oi1-w453-e11m875e533l | 480000…9999 |

| Jennifer J. Morrison | jenniferm@example.com | 987654 | hr946db8-e1ob-3jk7-b860-c45b112e765e | 460000…1234 |

| Narayan Singh | nsingh@example.com | 456123 | oi866db3-o1kk-1es7-e461-v87e643l744b | 440000…5678 |

To use the tokenised payment information in subsequent transactions, pass the consumer_id and customer_email that you have stored for the customer. In order for your customer to select which saved card (token) to use, display the masked PAN to your customer in your payment form. Pass the associated token based on your customers’ selection.

consumer_id, token, and its associated customer_email:

<?xml version=”1.0″ encoding=”UTF-8″?>

<payment_transaction>

<transaction_type>sale</transaction_type>

<transaction_id>119643250547501c79d8295</transaction_id>

<usage>40208 concert tickets</usage>

<remote_ip>123.456.789.0</remote_ip>

<amount>100</amount>

<currency>USD</currency>

<token>ee946db8-d7db-4bb7-b608-b65b153e127d</token>

<cvv>123</cvv>

<customer_email>jsmith@example.com</customer_email>

<customer_phone>+1987987987987</customer_phone>

<consumer_id>123456</consumer_id>

</payment_transaction>consumer_id parameter is not passed in subsequent transactions, the gateway will not process the payment.