POS Chargebacks

Learn how to manage chargebacks and disputes with Mastercard and Visa.

A chargeback happens when a customer disputes a transaction that has already been cleared and settled. Common reasons for a dispute include dissatisfaction, fraud, or processing errors. In such cases, both the customer’s bank (issuer) and your bank (acquirer) follow a set process to resolve the issue. This process determines whether you keep the payment or if the funds are refunded to the customer.

If the chargeback is approved, the disputed amount is transferred from your bank (acquirer) to the customer’s bank (issuer). Chargebacks can generally be filed within 540 calendar days from the transaction date.

MASTERCARD

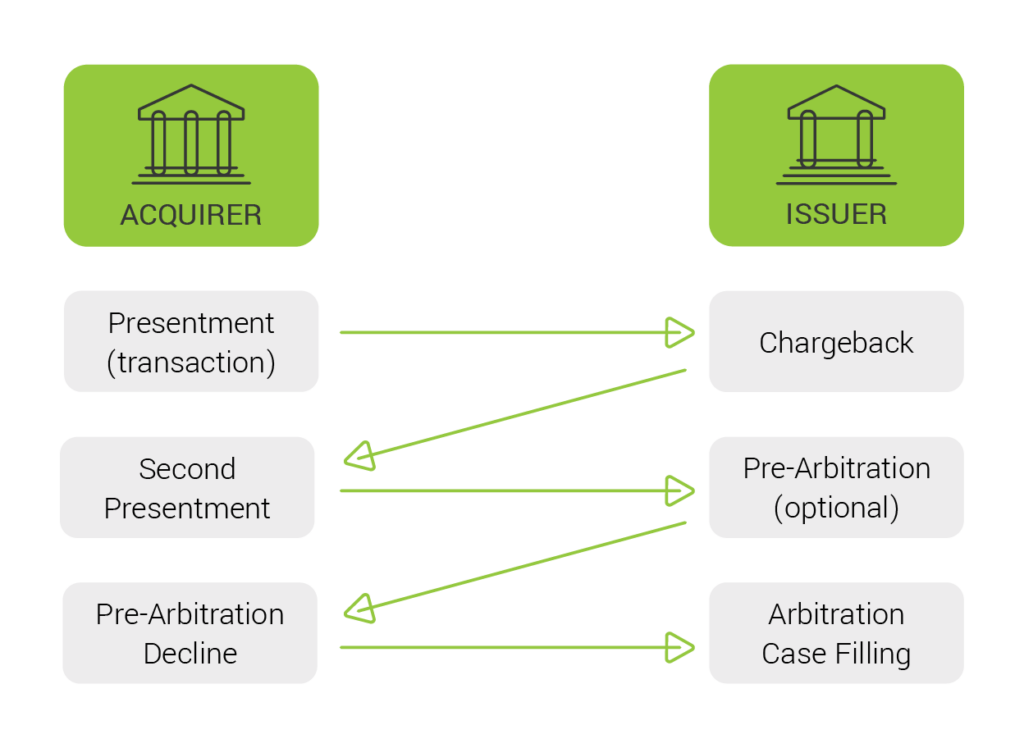

Mastercard chargeback resolution process

The Mastercard chargeback resolution process consists of several key stages. It begins with the presentment of the transaction, followed by a chargeback initiated by the issuer if the transaction is disputed. The acquirer may respond with a second presentment to represent the transaction. If the dispute persists, the process can escalate to pre-arbitration (optional) and, ultimately, to arbitration case filing for a final decision.

Mastercard Pre-Arbitration

Pre-arbitration occurs when the customer or their bank believes the initial chargeback (representment) was handled incorrectly. This process allows the customer’s bank to challenge the resolution before escalating the dispute to arbitration. Pre-arbitration must occur before arbitration in all cases, except for those specifically excluded by Mastercard’s rules.

Mastercard Arbitration

Arbitration is the final stage of the dispute process. If you and the customer’s bank cannot resolve the dispute during earlier stages, the arbitration committee (Visa or Mastercard) makes the final decision. The party responsible for the disputed transaction can file for arbitration.

Pre-Compliance and Compliance

The compliance procedure is initiated when either the customer’s bank or your bank believes there has been a violation of Mastercard rules, and there is no right to chargeback or representment. The requesting bank must show that it incurred financial loss due to the violation.

Arbitration and Compliance Fees

The fees for arbitration and compliance cases are the same. Mastercard assesses different fees depending on whether the transaction is intra-European or inter-regional. These fees are collected from the losing party based on the arbitration committee’s decision.

VISA

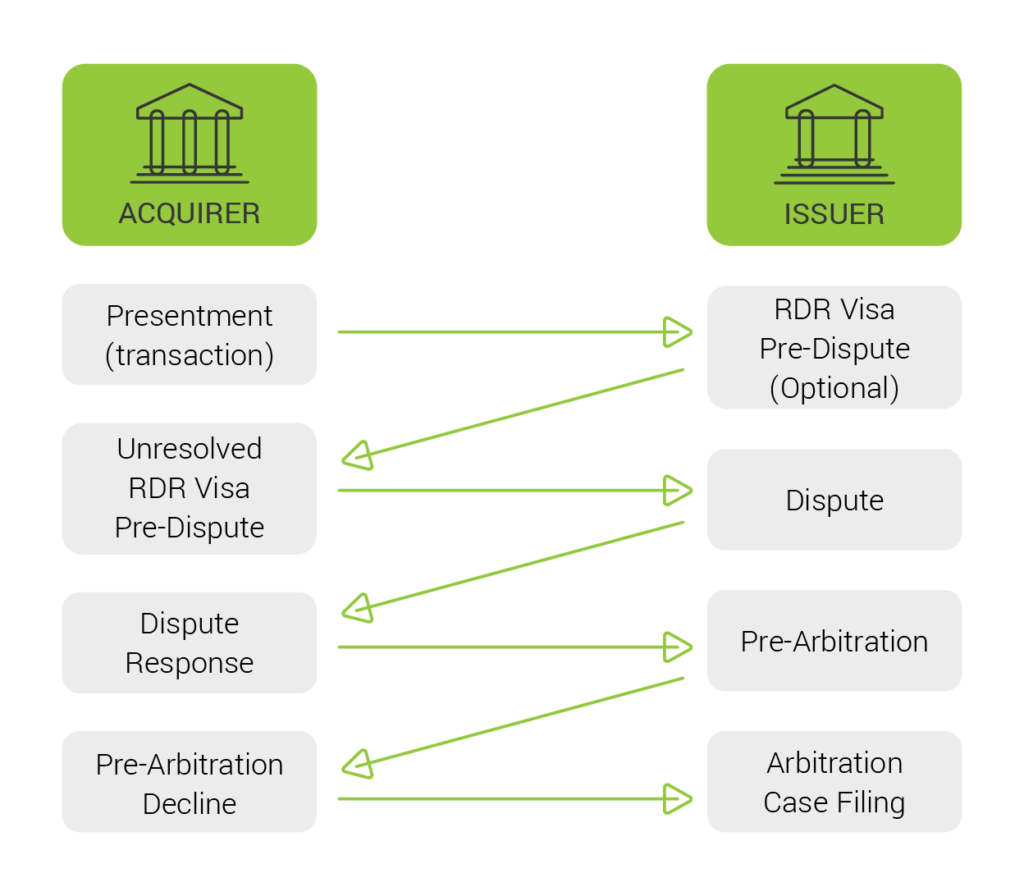

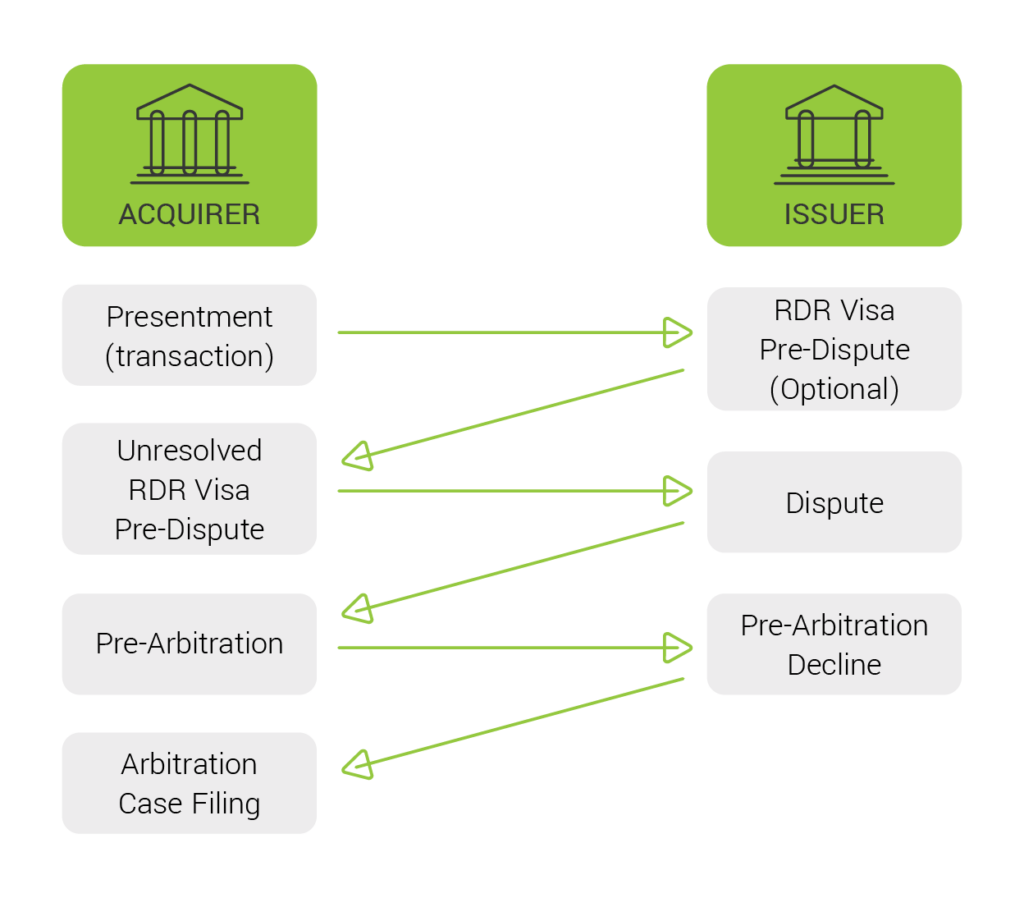

Rapid Dispute Resolution (Visa Pre-Disputes)

Rapid Dispute Resolution (RDR) is a pre-dispute resolution system that operates on the Visa network and Verifi platform. If you are enrolled with Verifi, RDR allows for the resolution of disputes before a chargeback is initiated. Pre-disputes are categorized separately from chargebacks and do not count towards the monthly dispute total. If you accept a pre-dispute, no further actions, such as representment or pre-arbitration, are available.

Disputes

A dispute is a transaction reversal initiated by the customer’s bank when the customer disputes a transaction on their credit card statement. Once processed, the disputed amount is transferred from your bank (acquirer) to the customer’s bank.

Visa Pre-Arbitration

There are two types of pre-arbitration processes in Visa disputes:

- Visa collaboration dispute flow

- New evidence or documentation is provided by the customer’s bank.

- You have provided compelling evidence, and the customer’s bank has contacted the customer to review the evidence and explain why the dispute remains unresolved.

- Visa allocation dispute flow

If the customer’s bank believes a chargeback was resolved incorrectly, they can initiate pre-arbitration to try to resolve the issue with you. This stage is mandatory if:

In this flow, you raise pre-arbitration when you disagree with the chargeback. If the customer’s bank rejects the pre-arbitration, you will be notified. You then have five days to decide whether to proceed with arbitration.

Visa Arbitration

Arbitration is the final stage of the dispute process. If you and the customer’s bank cannot resolve the dispute during earlier stages, the arbitration committee of Visa makes the final decision. The party responsible for the disputed transaction can file for arbitration.

Pre-Compliance and Compliance

The compliance procedure is initiated when either the customer’s bank or your bank believes there has been a violation of Visa rules, and there is no right to dispute or representment. The requesting bank must show that it incurred financial loss due to the violation.

Arbitration and Compliance Fees

The fees for arbitration and compliance cases are the same. Visa assess different fees depending on whether the transaction is intra-European or inter-regional. These fees are collected from the losing party based on the arbitration committee’s decision.